- The Runway Ventures

- Posts

- 🤯 Why 1Fit’s unlimited gym model was doomed to fail

🤯 Why 1Fit’s unlimited gym model was doomed to fail

The math didn't add up...

Hey Founders,

Welcome to The Runway Ventures — a weekly newsletter where I deep dive into failed startup stories to help you become the top 1% founder by learning from their mistakes with actionable insights.

Ever wonder how I snag big‑brand sponsors for my newsletter? Here’s the insider trick I’ve never shared:

I use The Grid to laser‑target decision‑makers at cash‑ready companies in Southeast Asia — complete with verified emails.

🔍 Hyper‑localised filters zero in on the right budget holders

📈 Reply rates skyrocketed — bookings closed in just 1–2 weeks

Stop chasing generic leads.

Get fewer contacts, better conversations, and faster deals.

Want higher-quality B2B leads in SEA & ANZ?

P.S. TRV readers unlock an extra 10% off an annual plan. Email [email protected] with this exclusive code (TheGridxTRV) to grab your spot. Limited to 10 spots only! 🤝🏻

Today’s story is about how 1Fit got killed by its power users due to a flawed business model. Let’s get to it! 🚀

Today at a Glance:

☠️ 1 Failed Startup → 1Fit

⚠️ 2 Mistakes → Unsustainable business model

🧠 3 Lessons Learned → Price for real human behaviour

🔗 The Runway Insights → Take 3 minutes to delete these words and improve your writing forever

💰 Southeast Asia Funding Radar → Timah Partners raises $50M (Series A) to fix Southeast Asia’s SME succession crisis

☠️ 1 Failed Startup: 1Fit

🚀 The Rise of 1Fit

🇰🇿 Founded by Murat Alikhanov and his co-founders (Abzal Toremuratuly, Askar Akshabayev, and Meir Adylzhanov) in Kazakhstan, 1Fit offered a monthly fitness membership subscription that allows people to access thousands of different fitness classes at partner studios.

The Problem — 🎫 Traditional gym memberships were rigid, expensive, and limited people to one location.

On the other hand, people wanted variety - yoga one day, swimming the next, maybe some boxing after that — but the fitness industry wasn't built for that kind of flexibility.

The Solution — 💪🏻 1Fit offered a single fitness subscription that would give people access to multiple gyms, studios and fitness classes across the city.

One monthly subscription fee → unlimited access to a variety of fitness classes.

🏋🏻♀️ Users loved the flexibility. It was like having a VIP pass to the entire fitness scene in the city.

🤑 Gym & studio partners were happy to get a steady stream of new customers.

🚴🏻♀️ In short, 1Fit is like the Netflix of fitness. Pay once, sweat anywhere.

😍 It was a no-brainer. I mean, who doesn’t like unlimited access to gym, yoga, swimming (you name it) with a flat monthly fee? The concept caught on fast. 🤑 By 2022, 1Fit had expanded beyond Kazakhstan into Uzbekistan, Kyrgyzstan and Azerbaijan, pulling in about $12 million in annual revenue (a 151% jump from the year before) — with 1.6 million workouts logged by users that year alone. |

Success breeds ambition, and 1Fit's founders were thinking big. Really big.

💰 They secured funding from TMT Investments, a UK-based venture capital fund. First, they raised $500,000 in December 2021, then another $500K in July 2023.

By 2023, 1Fit was operating successfully in Central Asia and decided it was time to conquer the world. They announced plans to expand into the UK, with London as their first international market.

Not long after, 1Fit set its sights on Southeast Asia. In early 2024, the team launched 1Fit in Malaysia (they also entered Mexico and the UAE around that).

🇲🇾 Malaysians were intrigued by the unlimited pass idea. Before long 1Fit had signed up hundreds of local studios.

In its first year in KL, members completed roughly 365,000 workouts across those partners. Trainers and newbies alike were eager to try this “all-you-can-exercise” deal.

📈 At its peak, revenue hit $20.2 million with 216 employees worldwide.

For a while, 1Fit seemed unstoppable and was on its way to making fitness accessible to everyone.

📉 The Fall of 1Fit

You can quickly figure out that the math doesn't add up.

🩸 But behind the flex, the business model was bleeding.

By early 2025, Murat admitted the company had burned a ton of cash on user acquisition. In Malaysia alone they’d poured about $4.2 million into marketing, promotions and gym payouts – but only generated about $2.7 million in sales.

Basically, they were bleeding to acquire users. The marketing was top-notch. Profit? Nope.

📌 Here’s what happened to 1Fit:

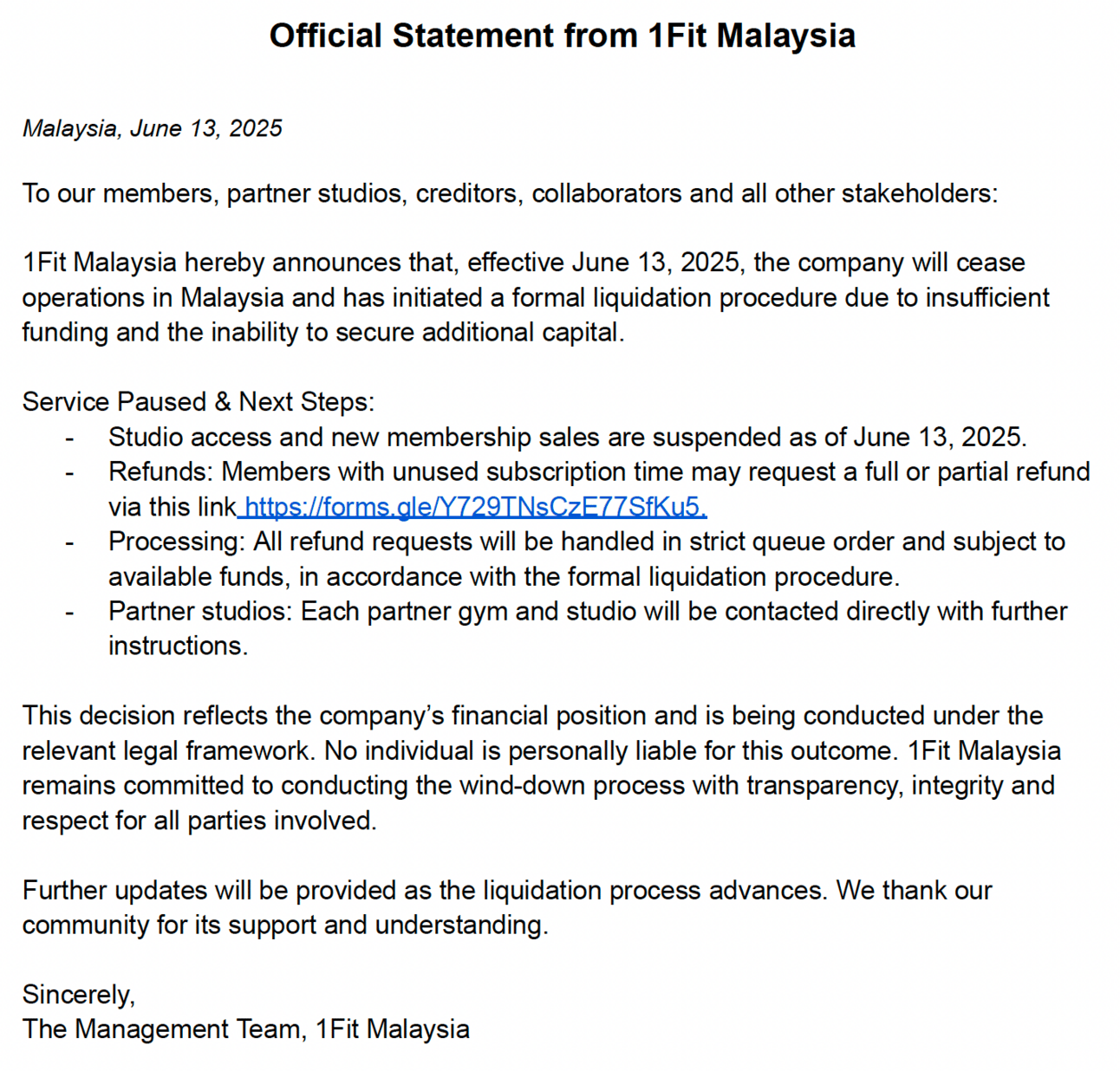

Official Statement from 1Fit Malaysia about Closing Down

🏋🏻♀️ Let’s conquer the fitness world

Aug 2017 — Murat Alikhanov, Abzal Toremuratuly, Askar Akshabayev and Meir Adylzhanov pivoted from software development to launch 1Fit in Almaty.

2018 — 1Fit officially launched its gym membership app in Kazakhstan.

Dec 2021 — 💰 1Fit closed its 1st seed round, raising about $500K led by TMT Investments.

2022 — Rapid Central-Asia expansion

1Fit added partners in Uzbekistan, Kyrgyzstan and Azerbaijan, reaching roughly $12M in revenue (up 151% year-on-year).

2022 — 🇷🇺 The company wrapped up its pilot in Russia and exited that market (likely due to geopolitical situation?).

Feb 2023 — 🇬🇧 1Fit announced launch in the UK.

Mid 2023 — ☠️ The UK venture was closed after losing ~$97K (operational for less than 6 months).

🤔 The unit economics didn’t work?

Jul 2023 — 💰 1Fit raised a 2nd seed round of $500K (TMT Investments again), bringing total funding to about $1M.

Feb 2024 — 🇲🇾 1Fit Malaysia went live (company incorporation in Nov 2023, public launch in early 2024).

Grew to 353 locations and over 60,000 registered users.

By October 2024, monthly revenue had grown to $167,000.

Aug 2024 — 🇲🇽 Launched in Mexico (Guadalajara)

Had 2,500 active users and 281 locations in Guadalajara, with plans to expand to Mexico City, León, and Querétaro.

The revenue projections looked promising, with targets of $500,000 by year-end.

Sep 2024 — 🇦🇪 Launched in UAE (Dubai)

😭 The math doesn’t add up

Apr 2025 — 🤔 Shut down Mexico operations due to financial strain and security threats.

The company faced what they described as "aggressive demands and threats from unidentified individuals”.

The situation became so severe that they had to evacuate their Kazakhstani staff back home for safety reasons (huh?).

One employee leaked the shutdown news to partners without permission, causing a chain reaction.

Partner studios immediately began blocking user access, and angry customers flooded social media with complaints.

🤦🏻♂️ What was supposed to be a "gradual and controlled exit" became a public relations nightmare.

13 Jun 2025 — ☠️ Shut down Malaysia operations and entered liquidation process due to running out of money.

Marketing Cost — $4.2 million

Revenue — $2.7 million

Loss — $1.5 million

Suddenly, users discovered they could no longer book new classes and their memberships were frozen with no clear refunds in hand.

Users who had paid up to RM3,500 (equivalent to a fresh graduate's monthly salary) for memberships were left scrambling for refunds.

Studio partners were left waiting on unpaid bills, and staff were shocked by the overnight announcement.

🔥 In a nutshell, 1Fit ran out of runway.

It couldn’t raise enough new investment to cover the losses, and its promises outran the cash in the bank.

The result?

🙏🏻 In Malaysia alone, over 600 users joined a WhatsApp group seeking refunds. Many had paid for 12-month memberships upfront, with some losing amounts equivalent to RM3,500 ($750+).

🙏🏻 Studio partners were also left hanging. One Pilates studio, Nana Pilates, claimed they were owed 50,000 MYR ($11,785).

🌏 They had a successful business model in Central Asia, but instead of perfecting it and expanding cautiously, they tried to conquer the world simultaneously. They ignored the warning signs from their UK failure, misunderstood local markets, and burned through millions of dollars chasing growth at any cost.

The saddest part? They actually solved a real problem that people wanted addressed.

The concept of flexible fitness memberships was sound — ClassPass proved that with proper execution and sustainable unit economics, this model can work. But 1Fit's execution was fundamentally flawed from the beginning of its international expansion.

Want to learn more about 1Fit’s downfall?

⚠️ 2 Mistakes

Mistake 1: Unsustainable business model

Fundamentally, 1Fit’s business model failed to assume the actual user behaviour in real life.

💵 Here’s how its business model works:

1Fit charged users around RM150–300/month.

For every visit to a studio partner, 1Fit had to pay the partner studio.

If someone booked 30–40 workouts that month, 1Fit had to pay partner studios per visit.

That added up fast — often more than the subscription fee.

So the more people used it, the deeper the hole got.

🏋🏻♀️ Super users = Super losses

The top 5–10% of users — aka “power users” — were way more active than expected.

Some did multiple classes per day.

And each of those sessions triggered another studio payout.

More usage didn’t mean more revenue — just more cash flying out the door.

Once 1Fit started losing money, studio payouts slowed.

Good gyms left the platform. The user experience tanked.

👨🏻🦯 1Fit’s biggest blind spot? Real human behaviour.

They didn’t design their pricing around how people actually behave. They assumed “average” usage, but the outliers — people who loved the product — broke the business.

The better the product worked for users, the worse it worked for the company. That’s not just unsustainable — it’s upside-down.

One fitness industry veteran even called it out bluntly:

The unlimited class model for a set monthly fee does NOT work.

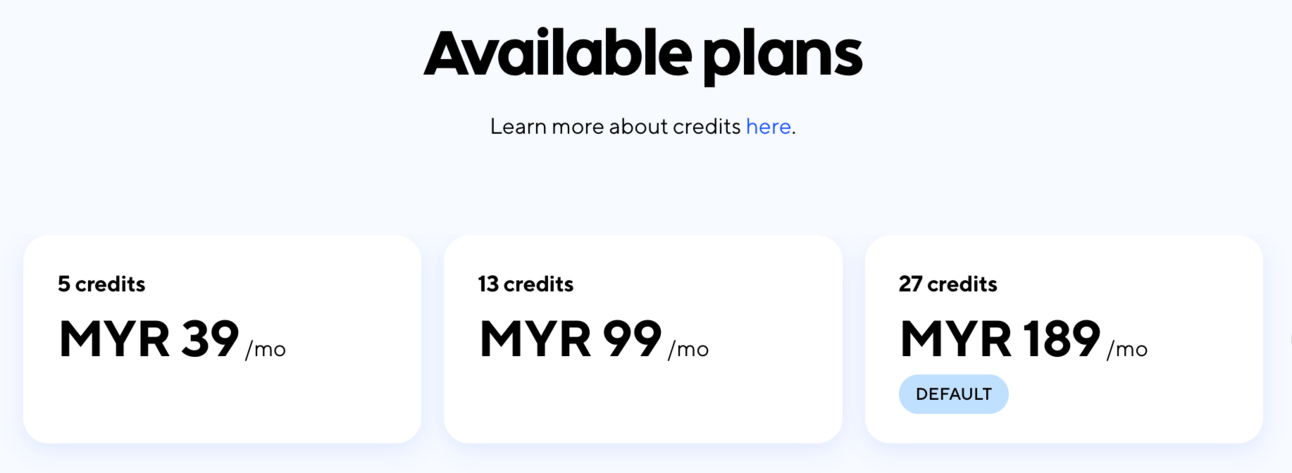

ClassPass, the OG in this space, abandoned unlimited pricing back in 2016 after their own burn issues. They pivoted to credit-based pricing to manage usage and margins.

Looking back, 1Fit's international failures followed a clear pattern:

Russia (2022): Exited due to geopolitical situation

UK (2023): Lost ~$97,000 in under 6 months

Mexico (April 2025): Chaotic exit due to financial strain and security issues

Malaysia (June 2025): $1.5 million loss, formal liquidation.

Each failure should have been a learning opportunity, but instead, 1Fit kept doubling down on expansion without fixing their fundamental unit economics.

Why?

Mistake 2: Growth > Profits + Ethics

Despite knowing the ship was sinking, they kept pushing for memberships. In June 2025, users paid up to RM3,500 for annual plans — days before shutting down.

Employees and gym partners were blindsided. Staff lost jobs overnight. Studios chased unpaid invoices.

🤯 You know what’s even crazier?

1Fit used the same trick to exit other regions:

The process of leaving the country isn’t new for us. We have gone through this in other regions, and occasionally we proceed step by step in a controlled manner

So it seems like this wasn’t something new to 1Fit. Was it accidental in Malaysia? I’m not sure.

But one thing is for sure…

🤝🏻 1Fit was laser‑focused on skyrocketing user numbers — every town, every city, every continent — so long as the sign‑up counter kept climbing. But in that rush, they sidelined two non‑negotiables — making money and doing right by partners and customers.

Unsustainable burn for vanity metrics

They poured millions into discounts, referral kickbacks, splashy ads — anything to boost the “hockey stick” growth curve — even when unit economics didn’t support it.

Ethical shortcuts backfired

When cash ran low, refunds stalled, studios went unpaid, and user credits vanished. People who paid their hard‑earned salary in advance found themselves locked out with no recourse. That betrayal hurt brand goodwill far more than any marketing spend could repair.

Lesson in trust

Growth built on shaky ethics is like building on quicksand — eventually it collapses, dragging your reputation (and your runway) down with it.

🧠 3 Lessons Learned

Lesson 1: Price for real human behaviour

1Fit’s "unlimited classes for flat fee" model was financial suicide.

Power users (5-10% of customers) booked 30-40 sessions/month, forcing 1Fit to pay studios more per visit than the subscription revenue.

ClassPass’s Pricing Plans

🌮 Key Takeaways:

🤑 Segment your user base by usage tiers. For example:

Tier | Classes/month | Suggested Pricing Structure |

|---|---|---|

Light | 0–4 | RM 120 flat (fits occasional users) |

Medium | 5–12 | RM 180 flat + 1 free guest pass |

Power | 13–24 | RM 240 flat + RM 8 per extra class |

Super | 25+ | RM 300 flat + RM 5 per extra class, capped at RM 450 |

⏰ Dynamic pricing for Peak vs. Off‑Peak

Peak‑hour (6–9 pm) classes cost more credits/overage fees than midday or weekend slots.

For example, Peak classes cost RM 10 extra, off‑peak RM 5.

Power users who train weak‑early might shift schedules to off‑peak, smoothing studio load and your payouts.

💪🏻 Use credit system (like ClassPass)

Users buy a bundle of credits. Each studio/class “costs” a set credit amount.

High‑demand studios cost more credits, which naturally throttles overuse and improves margins.

ClassPass continually analyzes peak times and adjusts credit costs weekly to maintain healthy utilisation.

Lesson 2: Profits + Ethics > Growth

1Fit grew at all costs.

When the company ran out of money, refunds stalled and studios weren’t paid. Users who’d dropped RM 3,500 found themselves blocked out, scrambling for answers.

Social media blew up, and partners felt betrayed.

🌮 Key Takeaways:

💰 Set growth “Profit Gates”

Define a profitability threshold before each new marketing push.

Only increase your referral bonus or run a “first month free” campaign if your post‑campaign LTV:CAC remains ≥ 3:1.

If a promotion tips that below 2:1, pause and re‑optimise.

🏦 Automate ethical checkpoints

Automatically siphon 5% of every subscription into an escrow fund earmarked for emergency refunds and partner payments.

For example, before you launch “All‑You‑Can‑Sweat” deals, ensure you hold enough in reserve to cover refunds for no‑shows or sudden market exits.

🤝🏻 Transparent exit playbook

Draft and pre‑approve “market shutdown” templates: clear timelines, refund processes, partner liaison contacts.

If you need to exit Kuala Lumpur, trigger an email sequence:

Day 1: “Here’s what’s happening, with pro‑rated refunds.”

Day 3: “Your refund is processing—here’s when you’ll see it.”

Day 7: “Thank you for being with us; here’s a partner network list for alternative options.”

Lesson 3: Master one market before going global

Treat each new city (or vertical) as its own “mini‑startup”

Nail product–market fit, unit economics, and operational playbooks locally before piling on new territories.

🌏 This is especially true when you’re expanding to Southeast Asian markets.

🌮 Key Takeaways:

🚀 Use the "80/10/10" Expansion Rule

80% of cash → core market (e.g., Kazakhstan).

10% → test new markets (pre-sell 500 Malaysian memberships without physical launch).

10% → emergency fund.

For example, ClassPass spent 3 years dominating NYC (8M users) before touching London.

🫡 Enforce a “Payback Period Gate”

Only expand marketing spend when CAC payback is under 6 months.

In the fitness context, If you spend RM 150 to acquire a user who only generates RM 200 in gross margin over 6 months, hold off on more ads and optimise your referral program first.

By doing this, you avoid replicating losses at scale and keep cash burn in check.

🔗 The Runway Insights

Take 3 minutes to delete these words and improve your writing forever (Link)

Why most founders fail to raise in 2025 and how you won’t (Link)

How the top AI startups prompt LLMs (Link)

a16z: 11 opportunities for builders across AI and crypto (Link)

How to hire A-players (without getting burned) (Link)

11 things you should NEVER do when building an app (Link)

💰 Southeast Asia Funding Radar

Timah Partners raises $50M (Series A) to fix Southeast Asia’s SME succession crisis (Link)

3cat, a Malaysian omnichannel platform for used electronics, raises Pre-Series A in funding to expand across SEA (Link)

Shiok Burger raises Pre-Series A in funding led by AC Ventures to expand their central kitchen and open new stores (Link)

Zilo raises $4.5M to expand fashion delivery beyond Mumbai (Link)

🤝🏻 Before you go: Here are 2 ways I can help you

Founder Office Hours: Book a 1-1 call with me, share your problems and questions, and I'll help you cut through the noise, avoid costly mistakes, and get clear next steps that actually work. I help early-stage founders with:

Validating ideas & building MVPs

Tech & product development

GTM strategy & fundraising

Finding PMF & growth hacks

Growing & monetising newsletters

Attract customers & investors by building a solid founder brand on LinkedIn

Promote your business to 18,000+ founders: Acquire high-value leads and customers for your business by getting your brand in front of highly engaged startup founders and operators in Asia.

💃 Rate Today’s Edition

What'd you think of today's edition?Your feedback helps me create better content for you! |

That’s all for today

Thanks for reading. I hope you enjoyed today's issue. More than that, I hope you’ve learned some actionable tips to build and grow your business.

You can always write to me by simply replying to this newsletter and we can chat.

See you again next week.

- Admond

Disclaimer: The Runway Ventures content is for informational purposes only. Unless otherwise stated, any opinions expressed above belong solely to the author.

Reply