- The Runway Ventures

- Posts

- 🤯 Why Sorabel Failed: A Case Study on Cash Burn and Timing

🤯 Why Sorabel Failed: A Case Study on Cash Burn and Timing

From $60M GMV to liquidation: How a 6-month runway and a risky rebrand killed Indonesia's 2nd largest fashion startup.

Hey Founders,

Welcome to The Runway Ventures — a weekly newsletter where I deep dive into failed startup stories to help you become the top 1% founder by learning from their mistakes with actionable insights.

Today’s story is about how Sorabel (the $60M fashion startup in Indonesia) hit 5M downloads, nailed 58% margins, and still shut down overnight. Let’s get to it! 🚀

Today at a Glance:

☠️ 1 Failed Startup → Sorabel

⚠️ 2 Mistakes → Scaling a high-burn model without a safety net

🧠 3 Lessons Learned → Always protect your runway (even when things look good)

🔗 The Runway Insights → YC: 15 startup mistakes to avoid

💰 Southeast Asia Funding Radar → Amperesand raises $80M (Series A) to power AI data centers

☠️ 1 Failed Startup: Sorabel

🚀 The Rise of Sorabel

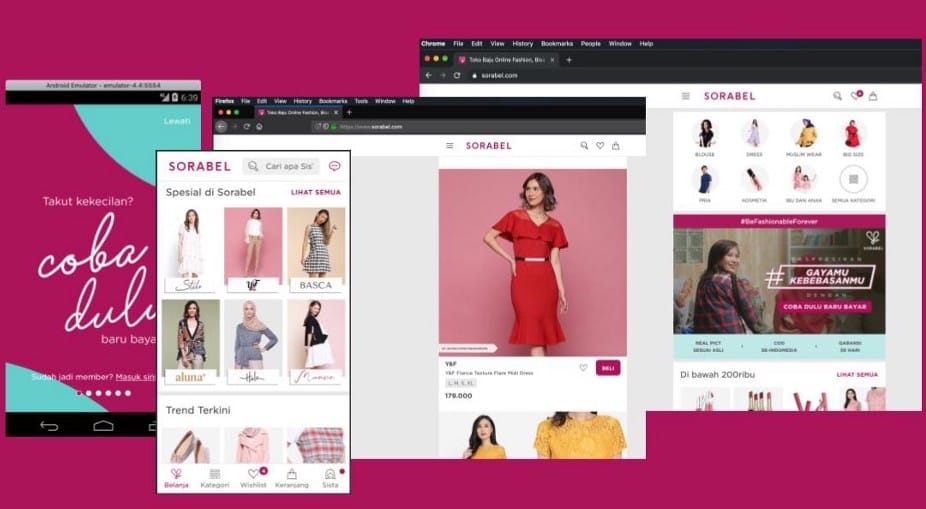

🇮🇩 Founded by Lingga Madu and Ariza Novianti in 2014, Sorabel (originally Sale Stock) was a fashion e-commerce startup based in Indonesia.

🕺🏻 Founders’ Story

In 2014, husband-and-wife duo Lingga Madu and Ariza Novianti launched Sale Stock (later Sorabel) from a humble garage in Yogyakarta.

They saw how women outside big cities struggled to find stylish clothes at prices they could afford. The couple started by sourcing cheap fashion from Jakarta and abroad, reselling it online through Facebook and WhatsApp.

Later, they brought in 3 more co-founders — Stanislaus Tandelilin, Ivan Samuel Heydemans, and Listiarso Wastuargo — to scale operations.

🛍️ What began as a side hustle turned into one of Indonesia’s hottest fashion e-commerce startups.

The Problem — 👗 Fashion outside of Indonesia’s major cities was limited, expensive, and often inaccessible.

Consumers struggled to find trendy, well-fitting clothes at affordable prices.

There was a huge gap between what was available in fancy urban malls and what everyday Indonesians could pay.

The Solution — 🛍️ Sorabel created its own affordable fashion line, eliminated middlemen, and introduced innovative services like “Try First, Pay Later”, where customers could try on clothes at home before committing to buy.

This solved issues around affordability, quality, and online purchase trust.

🔥 In short, Sorabel was an Indonesian fashion e-commerce startup that made trendy, affordable clothing accessible to women across the country — especially outside major cities in Indonesia.

💪🏻 In the early days, the founders literally traveled to wholesale markets in Jakarta, Thailand, and even China, buying clothes to resell at low prices back home. 🤑 They operated through a website and even took orders via Facebook Messenger, WhatsApp, and LINE – whatever was convenient for customers. Oh, and they also ran on a “no discounts” policy but kept prices dirt-cheap by cutting out middlemen and selling direct online. ⚡️ Essentially, they were building Indonesia’s own version of fast-fashion e-commerce, minus the luxury markups. |

👗 In 2016, after realising the inconsistent product quality issue, Sale Stock started making its own clothing line for 3 reasons:

Ensured every stitch and button met their standards

Maintained decent margins

Keep customers happy

🤯 Because of this pivotal move, the company’s sales grew 8x from 2016 to 2019 while profits (gross profit) jumped 6x, according to Yuwono.

👚 One of Sorabel’s standout features was “Try First, Pay Later” — couriers would wait 15 minutes while customers tried on clothes, paying only for what they kept.

It was like a fitting room at your doorstep, solving trust issues around fit and quality for new e-commerce users. Though expensive at first with high return rates, the service eventually boosted loyalty as customers grew confident in Sorabel’s sizing and quality.

🏔️ By late 2018, Sorabel was unstoppable:

5M+ app downloads across Indonesia

Ranked as the #2 most-visited fashion e-commerce site in the country (after Zalora)

Employed around 800 people, including 20+ in-house fashion designers

Claimed 9% market share in Indonesia’s women’s fashion e-commerce segment

Generated ~80% of sales from its private-label fashion line

Reached ~58% gross margins, significantly higher than typical marketplaces

Was reportedly nearing break-even by 2019

🤑 The company was printing money. By early 2019, they were sitting on a GMV (Gross Merchandise Value) run rate of USD 60 million, with monthly revenue reaching USD 5 million by the end of 2019.

💰 They'd even raised another massive round: $27 million in Series B funding in August 2017 from investors like Gobi Partners, Alpha JWC Ventures, and others. By 2019, they'd raised debt financing of $2 million from InnoVen Capital (backed by Temasek and UOB Group). The company had raised $

In January 2019, they rebranded from Sale Stock to Sorabel. Why? Because they wanted to shed the image of "cheap stuff" and position themselves as a premium, inclusive fashion brand.

By mid-2019, they were planning to expand to the Philippines under the brand "Yabel".

CEO Jeffrey was talking about the company like it was the next Zara or ASOS of Southeast Asia. They had the cash, they had the traction, they had the investors' backing.

Everything looked perfect on paper.

📉 The Fall of Sorabel

… until it wasn’t.

⚠️ Behind Sorabel’s glossy growth, cracks were already forming — management shake-ups, a risky rebranding, and cash-burning customer promises started to pile up, turning that dream into a struggle for survival.

📌 Here’s what happened to Sorabel:

Sorabel was not yet profitable, though it had gross margins of 58%.

👗 Buy, buy, buy

2014 — Sale Stock was founded in Yogyakarta by Lingga Madu and Ariza Novianti, starting from a home garage.

The startup began selling affordable women’s fashion online, aiming to disrupt big retail with rock-bottom prices.

Jan 2016 — 🙌🏻 Co-founder Lingga Madu brought in Jeffrey Yuwono as President to bolster the leadership team.

Yuwono was a seasoned entrepreneur who later became Sorabel’s CEO.

Sep 2016 — 🙏🏻 In a difficult move, Sale Stock laid off ~220 employees despite steady growth, as a measure to control costs and extend its financial runway.

Aug 2017 — 💰 Raised a $27 million (Series B) funding round led by Gobi Partners, with participation from Alpha JWC Ventures, Convergence Ventures, Korea Investment Partners, SMDV (Sinar Mas), and MNC Media.

This big infusion was used to strengthen operations and move toward profitability.

2018 — 👑 Jeffrey Yuwono took over as CEO, succeeding Lingga Madu in the top role.

The company focused on improving product quality and scaling up its own fashion line, achieving significant growth in users and sales.

Jan 2019 — 🔥 Rebranded from Sale Stock to Sorabel to refresh its image and appeal to a broader fashion-conscious audience (shaking off the “cheap outlet” perception from the old name).

Revenue grew 2.4x after the rebrand.

Mid–2019 — 🇵🇭 Expanded to the Philippines with a trial launch of “Yabel”, aiming to bring its affordable fashion model to a similar market.

Around the same time, Sorabel peaked in popularity domestically — it’s the 2nd-most visited fashion e-commerce site in Indonesia in late 2018/early 2019, and the company boasted roughly 800 employees.

🚀 By Q4 2019, Sorabel achieved:

Double-digit monthly revenue growth (10–20%)

CM3 positive (contribution margin after marketing = positive)

Gross margin of 58%

Jul 2019 — 📣 The CEO publicly announced they were working on securing a Series C funding round primarily from Chinese investors.

Sorabel also secured 2 undisclosed bridge rounds + venture debt financing from InnoVen Capital to support its growth plans.

Investors were optimistic as the startup neared break-even.

The plan? Achieve profitability by Q1 2021 with a leaner and more flexible supply chain.

Aug 2019 — Widijastoro Nugroho (CMO) and Garindra Prahadono (CTO) left.

💸 Burn rate was too high

Feb 2020 — 🤯 Facing a cash crunch and the oncoming pandemic, Sorabel shut down its Philippines subsidiary (Yabel) to cut losses.

The focus shifted back to the core Indonesian business as the COVID-19 crisis began to unfold.

Mar 2020 — 🙅🏻♂️ COVID-19 disrupted everything:

Investors couldn’t fly to Jakarta for due diligence.

Term sheets were pulled.

All talks stopped overnight (“from meeting 10 investors weekly to zero”).

Apr-Jun 2020 — 📉 Sales collapsed.

Fashion demand dropped 50–70% across Indonesia.

Sorabel’s customers (middle & lower-middle class) were hit hardest by layoffs.

Website traffic crashed from 1.15M visits in March → 410k in April.

Hari Raya season (normally peak revenue) saw record-low fashion sales.

Stock couldn’t be replenished due to supply chain disruptions.

Jul 2020 — ☠️ Sorabel announced its closure.

An internal memo (dated late July) informs staff that operations will cease and all employees will be released by July 30, 2020.

The company filed for liquidation, citing an inability to overcome financial struggles compounded by the COVID-19 pandemic.

Employment will end for everyone effective July 30. Certainly no one expected this to happen.

In the end, Sorabel wasn’t killed by a bad product or weak demand — it was killed by timing.

The company finally fixed its margins, rebuilt its brand, and was days away from securing the funding it needed to scale sustainably.

Then COVID-19 slammed the door shut. With a chronically short runway and a core market devastated by the pandemic, Sorabel simply couldn’t hold on long enough to survive the shock.

🤔 Timing? Or luck? What do you think?

Want to learn more about Sorabel’s downfall?

⚠️ 2 Mistakes

Mistake 1: Scaling a high-burn model without a safety net

Since 2016, we’ve never had more than six months of runway. This provided good discipline in that we had to always be ultra-focused on making improvements to merit more new funds. However, the margin of error was so small and certainly not enough to survive the force majeure of a global pandemic.

💵 Sorabel grew fast, but the company never had more than 6 months of runway — even after raising a $27M Series B.

They built warehouses, expanded headcount, launched overseas, and ran a “Try First, Pay Later” model that was amazing for users but insanely expensive to operate.

It solved trust issues, sure, but at a crazy cost per order, especially as Sorabel scaled.

Delivery costs, returns, repackaging, and operational headaches burned cash faster than they could patch holes — even when order volume looked sexy on the dashboard.

When your business only works as long as cash keeps flowing…

🫨 One unexpected shock (hello COVID) can wipe you out.

Mistake 2: Branding shift that confused their core audience

The main reason is that rebranding is capital-intensive and difficult, while we had high-growth targets and limited funds.

Sale Stock was beloved by middle-low income shoppers who wanted cheap, trendy clothes.

⚡️ Then the company tried to “level up”:

→ rebranded to Sorabel

→ positioned itself as more “exclusive”

→ pulled away from its original bargain-hunter identity

The result?

😕 A chunk of old customers didn’t follow.

🤔 New customers didn’t fully trust the brand yet.

Rebrands are expensive — and deadly if done too early or too late.

🧠 3 Lessons Learned

Lesson 1: Don’t build a hero product that your wallet can’t support

✨ Sorabel’s “Try First, Pay Later” was the kind of feature every founder dreams of — customers loved it, trust skyrocketed, and the experience felt magical.

But behind the scenes? It was crazy expensive to run:

Couriers waiting outside for 15 minutes

High early return rates (nearly 300% at one point)

Double handling costs

Cash collection at the doorstep

Inventory delays and shrinkage

It solved a real problem… but the business model couldn’t absorb the cost long-term.

🌮 Key Takeaways:

🧪 Stress-test every feature against a “half the money” scenario

Ask yourself, “If my budget was cut by 50%, could I still run this feature profitably?”

If the answer is no, redesign it or park it.

😍 Make customer delight scalable (not expensive)

For example, if you’re running an e-commerce business in SEA, you can:

Replace courier wait-times with smarter sizing tools

Incentivise prepaid instead of COD

Offer virtual try-on instead of doorstep try-on

Train customers to trust standardised quality

Shopee and Lazada win in Southeast Asia by keeping fulfillment cheap and fast, limiting hands-on features only to top spenders and finding automation levers fast.

Lesson 2: Always protect your runway (even when things look good)

Sorabel was growing 2.4x after the rebrand. Q4 2019 margins were positive. On paper, they looked unstoppable.

💸 But they still had less than 6 months of cash.

When COVID hit, the underlying weakness was exposed.

🌮 Key Takeaways:

🙏🏻 Aim for 12–18 months of runway at all times

This gives you space to make mistakes, test new ideas, survive bad quarters, negotiate with investors without desperation, and avoid “bridge rounds from hell”.

Even if things are going great, pad the runway.

💰 Raise money when you don’t need it

This sounds counterintuitive, but it’s the ultimate founder hack, and I’ve heard the same advice from founders who have fundraised multiple times before.

Because when numbers look good:

Investors respond fast

You get better valuations

You negotiate from strength

Term sheets close easily

Sorabel waited until the growth rebound to raise Series C — but by then, runway was already thin. When COVID hit, investors disappeared overnight.

Lesson 3: Timing is important

🤕 Sorabel died because of bad timing.

They had just rebranded.

They had just fixed margins.

They had revenue growing 2.4x.

They had term sheets on the table.

They were finally on track for profitability.

And then COVID walked in, slammed the door shut, and turned all their “almosts” into “never happened.”

Investors who were ready to close couldn’t fly to Jakarta.

A Series C that should’ve saved the company evaporated overnight.

Their entire core market (middle-income women) stopped buying fashion completely.

😩 Sometimes, you can do all the right things — just at the wrong time.

🌮 Key Takeaways:

🦢 Assume at least one “black swan” will hit your startup

It could be:

A regulatory change

A pandemic (yep)

A sudden competitor price war

Supply chain breakdown

A funding market freeze

Build a business that can survive turbulence, not just sunny weather.

💸 Keep fixed costs low so timing can’t kill you

If you’re lean, you can survive bad quarters.

If you’re bloated, one bad month can end you.

💪🏻 Luck matters. Timing matters. But resilience matters more.

You can’t control when a storm hits — but you can control whether your company is built like a paper house or a concrete bunker.

Build for the lucky days — but prepare for the unlucky ones.

Finally, always be paranoid.

🔗 The Runway Insights

💰 Southeast Asia Funding Radar

🤝🏻 Before you go: Here are 2 ways I can help you

Founder Office Hours: Book a 1-1 call with me, share your problems and questions, and I'll help you cut through the noise, avoid costly mistakes, and get clear next steps that actually work. I help early-stage founders with:

Validating ideas & building MVPs

Tech & product development

GTM strategy & fundraising

Finding PMF & growth hacks

Growing & monetising newsletters

Attract customers & investors by building a solid founder brand on LinkedIn

Promote your business to 18,000+ founders: Acquire high-value leads and customers for your business by getting your brand in front of highly engaged startup founders and operators in Asia.

💃 Rate Today’s Edition

What'd you think of today's edition?Your feedback helps me create better content for you! |

That’s all for today

Thanks for reading. I hope you enjoyed today's issue. More than that, I hope you’ve learned some actionable tips to build and grow your business.

You can always write to me by simply replying to this newsletter and we can chat.

See you again next week.

- Admond

Disclaimer: The Runway Ventures content is for informational purposes only. Unless otherwise stated, any opinions expressed above belong solely to the author.

Reply