- The Runway Ventures

- Posts

- 🤯 How Style Theory went broke trying to rent luxury

🤯 How Style Theory went broke trying to rent luxury

A $25M startup with SoftBank money, 200K users, and infinite hype — until reality hit. Inside the shocking downfall of Asia’s biggest fashion rental app.

Hey Founders,

Welcome to The Runway Ventures — a weekly newsletter where I deep dive into failed startup stories to help you become the top 1% founder by learning from their mistakes with actionable insights.

Today’s story is about how Style Theory ended not with an IPO or an acquisition, but with an abrupt shutdown after 9 years. Let’s get to it! 🚀

Today at a Glance:

☠️ 1 Failed Startup → Style Theory

⚠️ 2 Mistakes → Ignored the unit economics trap

🧠 3 Lessons Learned → Don’t over-rely on investors

🔗 The Runway Insights → Everything OpenAI announced at DevDay 2025

💰 Southeast Asia Funding Radar → Supabase raised $120M (Series E) at a $5B pre-money valuation

☠️ 1 Failed Startup: Style Theory

🚀 The Rise of Style Theory

🇸🇬 Founded in 2016 by Raena Lim and Chris Halim in Singapore, Style Theory built a subscription-based app where users could rent, wear, and swap designer pieces from a shared “infinite wardrobe”.

I know what you’re thinking, you’re right — it’s like Netflix for designer clothes and handbags.

🛍️ Founders’ Story

Raena Lim and Chris Halim co-founded Style Theory in 2016 in Singapore after Raena realised she had a closet full of clothes but nothing to wear. Raena had a background in finance and even worked in micro-finance in Kenya before joining Goldman Sachs, while Chris came from consulting (Bain).

Their “aha” moment came when they saw friends complaining about the same wardrobe dilemma — and decided to build a subscription fashion rental platform to let people access, rather than own, designer wear.

They jumped in without fashion experience; everything from sourcing to logistics was learned on the job — and Style Theory was born.

Oh, and Chris and Raena are both the co-founders and the husband-and-wife team.

The Problem — 👜 In Southeast Asia, women were spending heavily on clothes they wore only once (for weddings, dates, or events) and then stuffed them away.

Fast fashion made it worse: people bought more, wore less, and wasted tons.

So the core pain point Style Theory solved was this:

How can women enjoy variety and luxury fashion sustainably, without burning cash or adding clutter to their wardrobes?

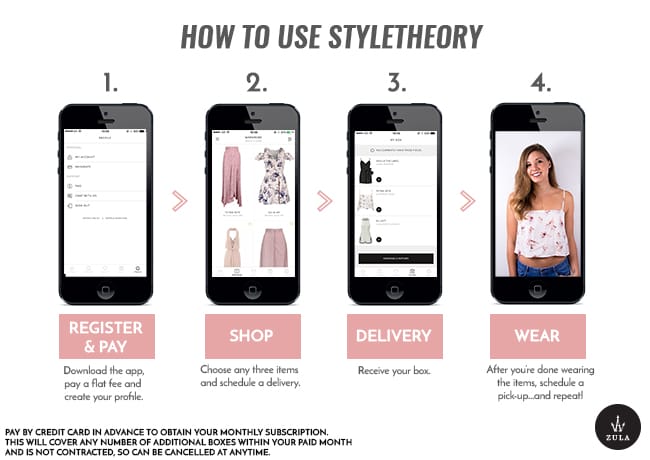

The Solution — 💃 Style Theory was a subscription-based fashion rental platform that let women rent luxury fashion items, wear them as long as they wanted, and swap them out whenever they got bored — all managed through one seamless app.

🤳 Browse & Rent — For a monthly fee (about S$89 to S$149), users could browse over 50,000 designer pieces and 2,000+ luxury bags, and choose what they wanted.

🎁 Delivery & Swap — Items were delivered to their doorstep, freshly dry-cleaned. When done, users could swap them for new ones anytime.

🧺 Sustainable Loop — Style Theory handled cleaning, quality control, logistics, and maintenance, extending each garment’s life.

🤑 Consignment System — They also allowed customers to consign their designer clothes and handbags — earning passive income when others rented them. This created a circular fashion ecosystem that benefited both renters and owners.

♻️ At its heart, Style Theory wasn’t just about fashion — it was about making luxury accessible and sustainable. It let people look and feel good while doing good for the planet.

🚀 Traction came fast. Even before launch, the idea garnered a waitlist of some 3,000 eager users in Singapore. 🇸🇬 → 🇮🇩 After a successful pilot launch in 2016 in Singapore, they expanded to Indonesia in 2017 backed by Alpha JWC Ventures and SoftBank (Series A). |

🏔️ At its peak, Style Theory was the region’s fashion rental powerhouse:

200,000 registered users on its platform by early 2020.

Customers were renting up to 20 pieces of clothing and 2 designer bags per month on average.

Saved over 600,000 pre-loved designer pieces from landfills

Delivered over 1 million items in total since launch.

Opened a chic flagship store on Orchard Road (Singapore’s prime shopping belt) in November 2019, cementing its brand as the go-to fashion library.

Raised a total funding of $25 million from prominent investors like SoftBank Ventures Asia, Alpha JWC and The Paradise Group.

Expanded to Hong Kong in September 2020.

🌏 At one point, the media was calling Style Theory "Southeast Asia's largest circular fashion platform", and everything seemed to be going according to plan.

It truly felt like Style Theory was on top of the world, poised to redefine fashion consumption in Asia.

📉 The Fall of Style Theory

At first, it looked like Style Theory had cracked the code — a beloved brand, loyal customers, and the backing of global investors.

But behind the polished marketing and chic Instagram posts, cracks were forming.

Logistics costs were mounting, investor patience was thinning, and post-COVID habits were shifting fast. The “infinite wardrobe” dream was starting to look unsustainably expensive.

📌 Here’s what happened to Style Theory:

The first red flag was when they didn't answer the problem at hand. Instead, they only told me they are having a warehouse situation, so they are sorry that they can't do any exchanges at this point in time.

💃 The Branded Days

Oct 2016 — Style Theory was founded in Singapore by Raena Lim and Chris Halim, with a mission to provide a sustainable alternative to fast fashion.

The startup began building a “closet in the cloud” for renting designer clothes and handbags.

2017 — 🇮🇩 Expanded to Indonesia, launching in Jakarta to tap the larger market.

💰 Around the same time, it secured a Series A funding round led by Alpha JWC Ventures and SoftBank Ventures Asia to support this growth.

Nov 2019 — ⛳️ Style Theory opened its first flagship store on Orchard Road in Singapore, offering a physical space for customers to browse and pick up rentals.

This move complemented its app-based service and boosted brand visibility.

Dec 2019 — 💰 Raised $15 million (Series B) led by SoftBank Ventures Asia (with participation from Alpha JWC and other investors).

By this point, Style Theory’s platform featured over 50,000 clothing items and 2,000 luxury bags, and had delivered more than 1 million rental items in total.

The fresh funds brought total funding to around $25 million and fuelled plans for regional expansion.

Sep 2020 — 🇭🇰 Launched in Hong Kong, debuting with a luxury designer bag rental subscription for HK$899 a month.

Hong Kong users could now rent from a catalog of 2,000+ authenticated designer bags via the Style Theory app.

Dec 2021 — Expanded its Hong Kong operations to include apparel rental, introducing its full “Infinite Wardrobe” clothing subscription in Hong Kong with a special HK$399 first-month offer for new subscribers.

This marked Style Theory’s official rollout of its dress rental service in the city, rounding out its offerings across markets.

🥵 Reality ate luxury for breakfast

Jun 2025 — ⚠️ Facing mounting challenges, Style Theory shut down its Indonesia branch and exited the market.

The founders announced they would focus on strengthening the business in Singapore and Hong Kong, the remaining 2 markets.

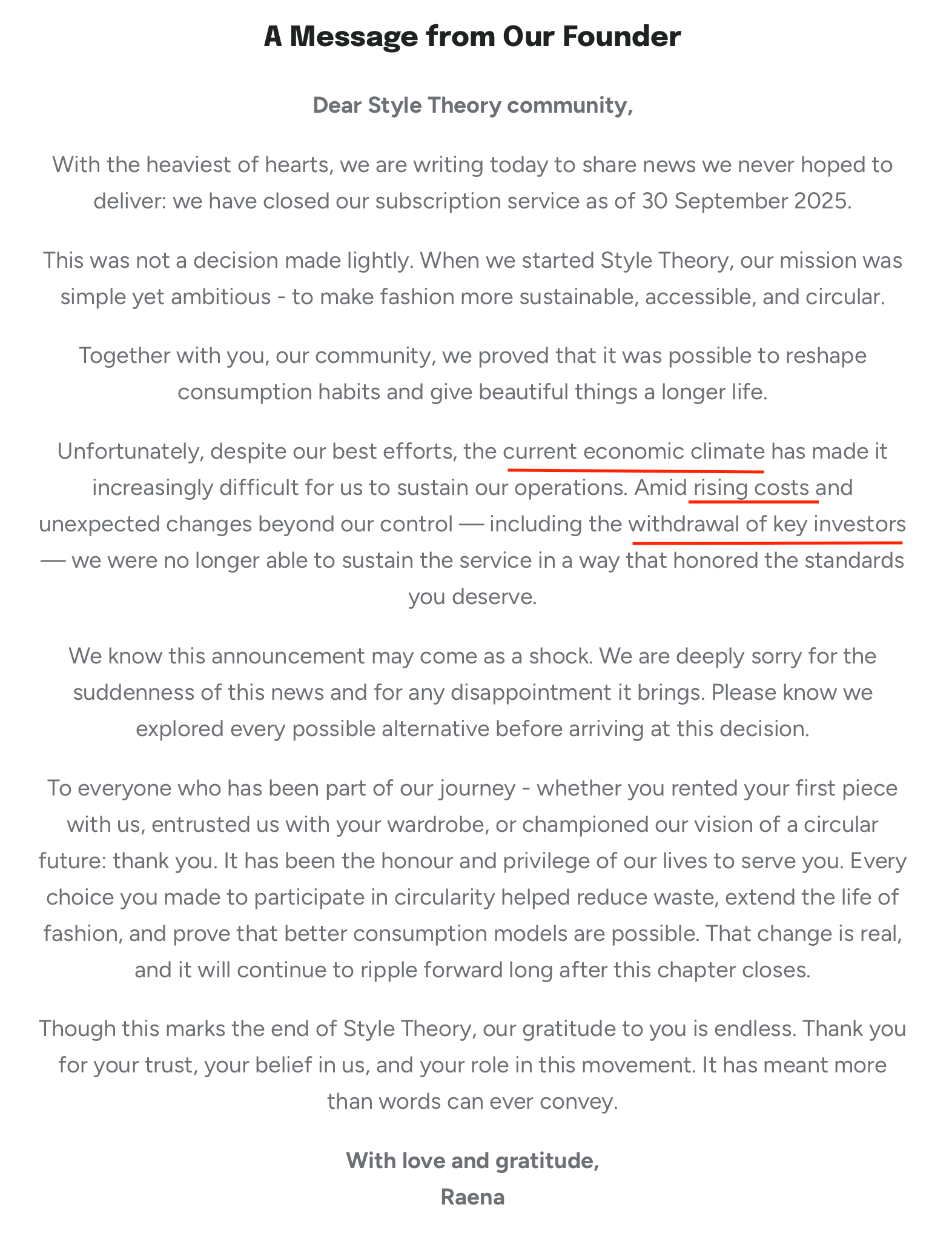

30 Sep 2025 — 😵 Suddenly, Style Theory ceased its subscription service and effectively halted all operations in its home market.

Everyone was shocked. No warning, no gradual wind-down - just a cold notice posted on their website and social media.

In an announcement on Oct 1, the company cited rising operating costs and the withdrawal of key investors as primary reasons for the shutdown.

All rentals, deliveries, and support were discontinued as of end-September, with no refunds issued for unused subscription periods.

The company prepared to file for liquidation, marking the end of Style Theory’s journey.

I don’t know what to do. Should I just wait for their updates, or should I do anything?” She added, “I don’t know whether the bag (a S$4,000 Louis Vuitton bag) is with them or is in one of the customers’ places. It’s a luxury bag, it cost a lot, and they still owe me the payout.

When the company went into liquidation, these consignors got the worst possible news: their property was now classified as "unsecured creditors". This meant they were at the bottom of the payout queue, behind banks and secured lenders. One consignor lost a $4,000 Louis Vuitton bag and had no idea if it was sitting in a warehouse or with a customer.

📈 Raena Lim and Chris Halim had a bold vision to change fashion consumption — and for a while, they really did.

📉 However, the subscription fees couldn’t keep pace with the costs, growth sputtered, and the cash ran dry when investors pulled back.

🙏🏻 In the end, Style Theory’s story ended not with an IPO or an acquisition, but with an abrupt shutdown after 9 years.

Want to learn more about Style Theory’s downfall?

⚠️ 2 Mistakes

Mistake 1: Ignored the unit economics trap

Style Theory scaled fast, but never cracked the math behind fashion rentals in Asia. Turns out, two-way logistics—shipping clothes out, cleaning, repairing, then shipping them back — is way more expensive than ordinary e-commerce.

🩸 Margins were razor-thin. They banked on growing big enough to make the costs work, but they underestimated just how tough break-even would be.

Each new market came with new logistics, culture, and fashion habits — meaning 3x the costs, but NOT 3x the revenue.

In short, it seems like the founders chased top-line growth, not sustainable profitability.

Mistake 2: Over-reliance on investor lifelines

🤑 Style Theory’s model was capital-intensive from day one.

They depended on VC money to fund inventory, cleaning facilities, and expansion. But after SoftBank’s 2019 Series B, they couldn’t raise another round.

When the funding climate cooled post-2021, new capital dried up — and Style Theory’s entire operation started to choke.

When investors pulled back in 2025, operations collapsed overnight.

🧠 3 Lessons Learned

Lesson 1: Unit economics first, then scale later

Revenue ≠ traction if your unit economics are negative.

Let’s break it down for Style Theory:

🟢 Revenue per user: ~S$100–150 per month

🔴 Cost per user: Cleaning, shipping, returns, repairs, storage — often exceeding S$120–170/month

🩸 Outcome: Each loyal customer increased losses, not profit.

Basically, the more customers they onboarded, the more losses they accumulated. Their business scaled in users, but not in margins.

🌮 Key Takeaways:

💰 Model unit economics early

Before scaling, calculate your true cost per customer — including hidden costs like support, logistics, and churn.

If LTV/CAC < 3, fix it before expansion.

For example, ClosetShare (Korea) and AirRobe (Australia) both grew slower but smarter, adopting peer-to-peer or consignment-only models to eliminate inventory risk.

Instead of buying assets, they became the platform that enabled access.

🙅🏻♂️ Kill vanity metrics

Don’t brag about GMV or total users if your margins suck.

Celebrate profitable growth, not raw growth.

🚀 Find your “Margin Lever”

For Style Theory, this could’ve been premium tiers, resale integration, or brand-sponsored collections to subsidise cleaning costs.

In your business, it might be automation, pricing, or distribution partnerships.

🥶 Simulate downturns

Ask, “If funding stopped tomorrow, can we survive on internal cash flow?”

If not — you’re scaling on hope, not math.

Lesson 2: Don’t over-rely on investors

It’s a founder’s worst nightmare — realising your business only survives as long as someone else believes in it.

Style Theory’s model depended on constant cash injections. Every designer dress, courier van, and dry-cleaning facility came from investor money, not profits. That’s fine when capital is cheap — but when the fundraising climate turns cold, your whole engine seizes up.

When investors pulled out in 2025, Style Theory’s entire cash flow collapsed in weeks.

🌮 Key Takeaways:

🤑 Design alternate revenue streams early

Style Theory could’ve diversified into resale or B2B fashion partnerships (like Rent the Runway did).

For you, it might mean consulting, licensing tech, or offering a lightweight SaaS product alongside your core business.

Every extra stream buys you more independence.

🧠 Understand investor psychology

Investors fund momentum, not miracles.

Once growth slows, most step back. Build relationships beyond capital — with customers, suppliers, and partners who keep you alive when markets shift.

💵 Be paranoid about capital efficiency

Think of every dollar raised as borrowed time.

Use it to test assumptions and tighten your flywheel — not to look “bigger”.

Lesson 3: Avoid a single point of failure

If there’s one thing COVID brutally exposed, it’s which businesses were built on adaptability… and which were built on assumptions.

Style Theory was the latter.

💃 When weddings, parties, and corporate events suddenly vanished, so did demand for designer rentals — the very foundation of their business. Their model depended almost entirely on people having reasons to dress up.

But when the world started dressing down, they didn’t pivot fast enough. Yes, they launched everyday wear and tried Hong Kong handbag subscriptions, but those tweaks were surface-level. The core engine — high-cost logistics tied to frequent turnover — stayed the same.

🌮 Key Takeaways:

🔥 Design for optionality

Don’t build a single-use business model.

Think about 2–3 adjacent pivots that your existing assets can support. (e.g., Style Theory could’ve monetised resale, cleaning, or logistics-as-a-service using their existing infra)

🤔 Scenario-plan like a pessimist

Ask yourself quarterly: “If our core use case disappears tomorrow, what can we still sell?”

For SaaS, that might mean modularising your API; for e-commerce, turning logistics into a service.

🧠 Stay close to customer behaviour shifts

Style Theory’s users didn’t stop caring about fashion — they just cared less about events.

A faster pivot into casual wear or circular resale could’ve bought them another runway.

🔗 The Runway Insights

Everything OpenAI announced at DevDay 2025 (Link)

How to spot billion-dollar markets before they look big (Link)

How to build a billion-dollar startup with a minimal team (thanks to AI) (Link)

How to use ChatGPT for competitive analysis (Link)

The Cofounder Relationship: Your Startup's Most Important Asset (Link)

💰 Southeast Asia Funding Radar

Supabase raised $120M (Series E) at a $5B pre-money valuation (Link)

Yup, a Southeast Asian digital bank, raises $32M (Series C1) to expand its customer base and enhance its digital banking offerings (Link)

Qapita raises $26.5M (Series B) to help private companies manage their cap tables and stock records (Link)

Valtor Solutions raises $700K (Pre-Seed) to help developers choose low-carbon products for their construction sourcing and procurement (Link)

🤝🏻 Before you go: Here are 2 ways I can help you

Founder Office Hours: Book a 1-1 call with me, share your problems and questions, and I'll help you cut through the noise, avoid costly mistakes, and get clear next steps that actually work. I help early-stage founders with:

Validating ideas & building MVPs

Tech & product development

GTM strategy & fundraising

Finding PMF & growth hacks

Growing & monetising newsletters

Attract customers & investors by building a solid founder brand on LinkedIn

Promote your business to 18,000+ founders: Acquire high-value leads and customers for your business by getting your brand in front of highly engaged startup founders and operators in Asia.

💃 Rate Today’s Edition

What'd you think of today's edition?Your feedback helps me create better content for you! |

That’s all for today

Thanks for reading. I hope you enjoyed today's issue. More than that, I hope you’ve learned some actionable tips to build and grow your business.

You can always write to me by simply replying to this newsletter and we can chat.

See you again next week.

- Admond

Disclaimer: The Runway Ventures content is for informational purposes only. Unless otherwise stated, any opinions expressed above belong solely to the author.

Reply