- The Runway Ventures

- Posts

- 🤯 The Fall of Zipmex: How a “Safe” Crypto Exchange Collapsed

🤯 The Fall of Zipmex: How a “Safe” Crypto Exchange Collapsed

Inside the $53M mistake, broken trust, and the hard lessons every founder should learn.

Hey Founders,

Welcome to The Runway Ventures — a weekly newsletter where I deep dive into failed startup stories to help you become the top 1% founder by learning from their mistakes with actionable insights.

Today’s story is about how Zipmex went from Southeast Asia’s “regulated crypto darling” to one of the region’s most dramatic collapses. Let’s get to it! 🚀

Today at a Glance:

☠️ 1 Failed Startup → Zipmex

⚠️ 2 Mistakes → Lack of risk management

🧠 3 Lessons Learned → Trust is the ultimate moat

🔗 The Runway Insights → From Idea to $650M Exit: Lessons in building AI startups

💰 Southeast Asia Funding Radar → Roojai, a Thai-based digital insurer, secures $60M from Apis Partners and Asia Partners

☠️ 1 Failed Startup: Zipmex

🚀 The Rise of Zipmex

🇸🇬 Founded by Marcus Lim and Akalarp Yimwilai in 2018, Zipmex was a Southeast Asia–focused crypto exchange that offered trading, custody, and high-yield “Earn” products across Thailand, Indonesia, Singapore, and Australia.

🕺🏻🕺🏻 Founders’ Story

Marcus Lim was an Australian entrepreneur who’d already exited OneFlare, a local services marketplace in Australia.

Akalarp Yimwilai was a Thai legal heavyweight with a Master’s from Georgetown and a doctorate in public administration, deeply plugged into the Thai establishment and regulators. He’d been a legal advisor and understood the Thai Ministry of Finance and SEC ecosystem inside-out, which is a huge deal in Thailand.

💪🏻 Together, they had a powerful split:

Marcus → raise money, build brand, expand regionally.

Akalarp → get the license, win trust in Thailand, navigate power circles.

The Problem — 🫣 People in SEA wanted crypto but struggled with dodgy offshore exchanges, DeFi complexity, and near-zero interest from traditional banks and low yields.

Zipmex was born out of a pretty simple question, “Why is it so damn hard for normal people in Southeast Asia to buy and earn on crypto safely?“

The Solution — 🤑 Zipmex was built as a regulated digital asset platform for people in Southeast Asia to:

Make crypto accessible to mass retail in SEA.

Make it feel safe via licenses and partnerships.

Give users yield that feels like a bank savings account, but pays much more.

🌏 In short, Zipmex was like the Coinbase of Southeast Asia — licensed, local, but with the yield and product range of a global exchange.

🤑 Here’s why people loved using Zipmex:

Users in Thailand used a regulated Thai app (Zipmex Thailand).

When they moved funds into “Z Wallet” / ZipUp+, those assets were actually being shifted from the Thai regulated entity to the Singapore/global entity, where regulation around lending was looser.

The Singapore entity then lent those assets out to institutional borrowers like Babel Finance and Celsius to generate the quoted high yields.

The results? Higher yields → more money baby!!!

🤫 But legally, once funds crossed into Z Wallet, they were effectively in a different jurisdiction and risk bucket — something most retail users didn’t really understand until everything blew up (more on this later).

🚀🪙 To pour rocket fuel on growth, Zipmex launched its own utility token ZMT (Zipmex Token), modelled after BNB/FTT:

Hold ZMT → higher yields on ZipUp+.

Hold ZMT → discounted trading fees.

Use ZMT → access to perks (ZipWorld), lifestyle rewards, and launchpad deals.

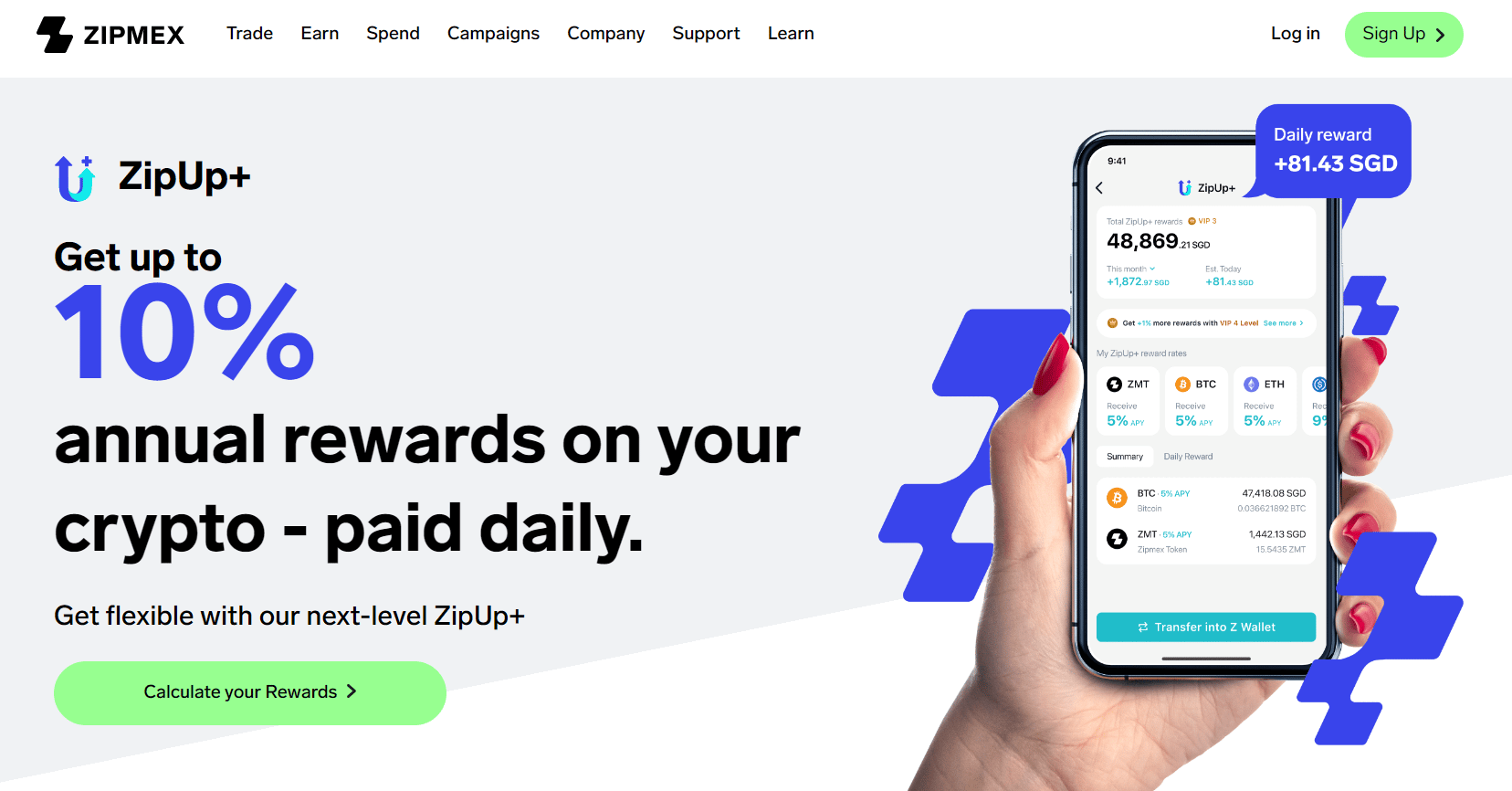

On top of that, the ZipUp+ product dangled up to ~10–14% APY on some assets — far above anything in traditional finance, but right in line with 2021’s “DeFi yield” hype.

🏄🏻♂️ Zipmex quickly expanded across Thailand, Indonesia, Singapore and Australia and even got licensed or regulated in each market. 💵 The traction was real. By late 2020, Zipmex had processed around $650M+ in gross transaction volume. |

💰 After a few rounds from early investors like Jump Capital, by August 2021, it had pulled in $41M in Series B led by Krungsri Finnovate (Bank of Ayudhya/MUFG), with B Capital, TNB Aura, V Ventures (linked to Thoresen Thai Agencies), and Thai media giants Plan B Media and Master Ad joining.

🤯 At its peak, Zipmex was eyeing a $400M+ valuation and even $1B in sight. According to someone familiar with the matter, Coinbase was preparing to acquire the entire company at $700M valuation. People were already reviewing employment contracts — until Coinbase’s stock crashed and the M&A was cancelled overnight.

It really felt like Zipmex was on top of the world. The founders promised this was an “Asia-Pacific digital bank” for crypto — trading, interest, and even their own token (ZMT) all rolled into one app.

📉 The Fall of Zipmex

But when the crypto bear market hit in 2022, everything collapsed. Everything.

💣 Because behind the glossy billboards, bank-backed investors, and “regulated” branding, Zipmex was sitting on a time bomb — one wired directly to Babel Finance, Celsius, and the entire Terra–3AC contagion.

📌 Here’s what happened to Zipmex:

Due to a combination of circumstances beyond our control including volatile market conditions, and the resulting financial difficulties of our key business partners, to maintain the integrity of our platform, we would be pausing withdrawals until further notice.

🚀🌕 To the mooooooooooooooon

Aug 2018 — Zipmex was founded by Marcus Lim and Akalarp Yimwilai, aiming to offer a regulated crypto exchange and high-yield “Earn” product to customers in Thailand, Indonesia, Singapore, and Australia.

Jan 2019 — 💰 Closed a $1.9M seed funding round.

2020 — Zipmex Thailand secured digital asset exchange and broker licenses from the Thai Ministry of Finance / Thai SEC, allowing it to legally operate an exchange and brokerage in Thailand.

Sep 2019 — 💰 Raised an additional $3M (pre-Series A).

Jan 2021 — 💰 Secured a $6M (Series A) led by Jump Capital (bringing total funding to ~$10.9M).

Launched high-yield products (ZipUp/ZipUp+) and markets returns up to ~10%+ APY for some assets, positioning itself as an “earn + trade” platform for SEA.

Aug 2021 — 💰 Closed a $41M (Series B) led by by B Capital and TNB Aura with Krungsri Finnovate, Plan B Media, and MACO among investors.

Sep 2021 — 💰 Added $11M more to Series B.

Jun 2022 — According to a close source, Coinbase entered talks to buy over Zipmex at a $700M valuation, but the deal later fell through after Coinbase’s stock crashed.

📉📉 Down, down, down

May 2022 — 🔥 Suddenly, Terra (LUNA/UST) collapsed, nuking ~US$60b in value and blowing holes in the balance sheets of funds like Three Arrows Capital (3AC).

12 Jun 2022 — ✋🏻 Then, Celsius Network paused withdrawals, citing “extreme market conditions”.

17 Jun 2022 — 🥶 Babel Finance suspended redemptions.

😱 Zipmex has ~US$48m with Babel and ~US$5m with Celsius, locking up ~US$53m in customer funds via its ZipUp+/Z Wallet program.

20 Jul 2022 — 🚨 Zipmex froze withdrawals amid the Terra/Babel/Celsius fallout.

Aug 2022

2 Aug — Resumed limited withdrawals of some assets (like altcoins) after halting service on July 20 as ordered by Thai SEC.

15 Aug — 👨🏻⚖️ A Singapore court granted Zipmex a 3-month moratorium extension (until early Dec 2022) for restructuring.

16 Aug — ‼️ Shareholders publicly asked CEO Marcus Lim to resign, blaming his decisions (especially the Babel exposure) for the cash crunch.

Zipmex held an EGM and focused on a recovery plan.

Dec 2022 — 🦄 Zipmex and Thai VC V Ventures announced a rescue deal.

V Ventures would buy ~90% of Zipmex for $100M (paying partly in cash, partly crypto).

The plan → inject new funds so customers can eventually withdraw their money by spring 2023.

23 Mar 2023 — The $100M deal hit a snag →V Ventures missed a $1.25M payment due Mar 23.

Zipmex warned it might have to liquidate its tech arm and suspend some payroll without that cash. The failed payment cast doubt on the buyout’s completion.

🚨 According to a close source (former employee), it did liquidate ZipX (VC arm) but 200+ employees in Thailand were left unpaid except the ones that had to stay on to keep the exchange and license intact. Till this day no one got paid and no one got severance.

30 Mar 2023 — 👨🏻⚖️ The Singapore High Court sanctioned Zipmex’s restructuring plan and approved an “administrative convenience” class for small accounts.

Moratorium was extended again (to Apr 23). This gave Zipmex legal cover to reorganise under court supervision.

Apr 2023 — Zipmex confirmed the buyout delays and said it will carry on with restructuring.

Creditors were told that if everything went well, customers could be “made whole” eventually, but the reality is grim.

Also in April, Zipmex acknowledged the V Ventures investor had missed 4 payments and warned of layoffs in its Singapore tech unit.

Jun 2023 — 👨🏻⚖️ Zipmex filed to extend its moratorium again (seeking to push deadlines into August).

Official updates reveal the old scheme with V Ventures was dead: the investor has walked away (“SSA terminated”), so Zipmex must propose new “schemes of arrangement” for creditors.

Those plans involved selling assets (like Zipmex’s Indonesian business and crypto reserves) to pay off debts.

The company projects creditors would recover only ~5.1% of what they were owed under this new plan. (By contrast, a straight liquidation would have yielded only ~1.6%.)

8 Feb 2024 — 🇹🇭 Thailand’s SEC charged Zipmex Thailand’s former CEO/co-founder Akalarp Yimwilai with fraud and halted the Thai exchange.

The regulator alleged that customer assets were transferred from Z Wallet to overseas wallets for Zipmex Global before terms & conditions were updated, and that false or misleading information was given to the public and regulator.

10 Jun 2024 — ❌ Thai SEC fully revoked Zipmex Thailand’s digital asset exchange and broker licenses and ordered it to shut operations, citing continued non-compliance and prior misconduct.

17 Feb 2025 — 🙏🏻 Money & Banking reported that Akalarp Yimwilai was sentenced to 5 years in prison for defrauding the public in relation to the Zipmex case, with damages cited in the billions of baht.

🥶 In the end, Zipmex failed because it overpromised and overreached. Its “funding” model (guaranteed high yields) depended on risky lending, so when the crypto winter struck and key partners froze up, Zipmex itself ran out of liquidity.

The big buyout rescue fell through when payments were missed, and the company ended up offering customers only a tiny fraction back (just ~5% under the court plan).

🤦🏻♂️ Regulators ultimately stepped in — even charging the former co-founder with deception.

Want to learn more about Zipmex’s downfall?

⚠️ 2 Mistakes

Mistake 1: Lack of risk management

✌🏻 Zipmex was heavily concentrated:

~$48m lent to Babel Finance

~$5m lent to Celsius Network

≈ $53m of customer funds in just 2 counterparties.

💣 When Terra/3AC contagion hit:

Celsius froze withdrawals (12 Jun 2022)

Babel halted redemptions (17 Jun 2022)

At that point, Zipmex was basically underwater. Their yield product depended on those 2 players not blowing up.

There was no real diversification, no visible hedging strategy, no clear risk limits on exposure to a single lender.

Once both counterparties went down and markets tanked, that $53m hole was too big to fill with new funding or trading revenue.

Mistake 2: Breach of trust

Zipmex’s whole brand was:

We’re regulated. We’re licensed. We’re safe.

They had a Thai digital asset license, bank-backed investors (Krungsri/MUFG, B Capital, etc.), and billboards all over Bangkok shouting “regulated digital asset platform.”

🚨 But the core engine of their business model wasn’t the spot exchange. It was:

Get users into the ZipUp+/Z Wallet high-yield product

Move funds from the Thai regulated entity to the Singapore/global entity

Lend those funds out to risky counterparties like Babel and Celsius to generate double-digit yield

😍 To a normal Thai user, moving funds into Z Wallet felt like:

I’m putting my money into a safe interest account at a licensed platform.

💩 In legal reality, it was more like:

I’m sending my savings offshore to a shadow bank that lends to leveraged crypto funds.

The Thai SEC later accused Zipmex Thailand of transferring customer assets abroad before updating T&Cs, and of giving false or misleading information about where funds actually were and how much exposure they had.

Once the illusion broke, trust evaporated overnight. And because their real business was that hidden lending engine, not just trading fees, the model collapsed with it.

🧠 3 Lessons Learned

Lesson 1: Manage and diversify your risk

Zipmex didn’t just lend out. They outsourced core balance-sheet risk to two players (Babel & Celsius) that were themselves highly leveraged and exposed to 3AC/Terra.

📒 That’s like building a whole logistics startup where 80–90% of your parcels go through one subcontractor in another country — and you never check their books.

🌮 Key Takeaways:

🧪 Set hard concentration limits

“No more than X% of user funds with any single external counterparty”

“No more than Y% of revenue from a single customer/partner”

🧯 Run “what if this partner dies tomorrow?” drills

Imagine Babel/Celsius vanish overnight. Can you:

continue operations without freezing withdrawals?

communicate clearly what’s affected (and what’s not)?

🕵️ Treat counterparties like you’d treat your own infra

Would you host your entire product on a random bare-metal server with no monitoring?

Same logic: lenders, logistics partners, suppliers — if they’re critical, they need real due diligence and ongoing monitoring, not just one nice pitch deck.

🧬 Design business models that degrade gracefully

If a partner dies, your model should bend (lower yield, tighter limits), not instantly snap.

For non-fintech founders: don’t make 70–80% of your product experience depend on one external API, vendor, or marketplace.

Lesson 2: Trust is the ultimate moat

🤔 What Zipmex did:

Marketed themselves like a licensed bank-adjacent exchange in Thailand and Singapore.

But made money like a leveraged wholesale lender — borrowing short from retail and lending long/risky to Babel, Celsius, etc.

That mismatch is what killed them.

🌮 Key Takeaways:

🔍 Don’t market one risk profile and run another

If you tell customers “this is safe / regulated / bank-like”, your internal model cannot be “YOLO leverage.”

If you’re running a SaaS company → don’t sell “mission-critical uptime” if you’re hosting on a single cheap server with no redundancy.

📊 Map your model like a regulator would

Literally draw → where does the money come from, where does it go, where’s the risk.

Ask, “If this blew up, would my marketing look misleading or fair?”

🧱 If your edge is trust, treat it as sacred infrastructure, not ad copy

For fintech, that means real segregation of funds, real risk committees, real independent oversight — not just logos on a deck.

Lesson 3: In a crisis, tell the ugly truth fast

🙏🏻 Zipmex had a short window in June 2022 to say:

“We got hit. Here’s exactly how. Here’s the hole. Here’s what we’re trying. Withdrawals will pause in XYZ way. Here’s the legal structure, here’s who is affected.”

🫸🏻 Instead:

They waited weeks after Celsius/Babel froze before stopping withdrawals.

The first big message to users was the generic “circumstances beyond our control” statement.

Thai SEC later alleged misreporting and concealment of facts, which escalated into criminal complaints and a 5-year sentence for Akalarp.

🌮 Key Takeaways:

🧊 Define your “oh sh*t” playbook before you need it

Who speaks? What do you disclose? What gets paused immediately?

For a fintech/crypto exchange → pre-draft the “we’re freezing X, here’s why, here’s what we know/don’t know” email before there’s blood in the water.

📣 Over-communicate facts, under-promise outcomes

Be concrete about:

size of the hole

who’s affected

what’s legally ring-fenced and what isn’t

Don’t promise “everyone will be made whole” unless you’re actually holding the money.

🧑⚖️ Assume regulators will read every message later with a highlighter

If your tweets, emails, lives, and terms conflict with your actual risk, you’re gifting prosecutors evidence.

For non-fintech founders → similar story with investors, customers, and employment claims — everything you say during a crisis will be replayed later.

🪓 Separate ego from governance

Marcus (co-founder of Zipmex) publicly refused to step down unless new investors explicitly forced him.

In a real crisis, having an independent board / restructuring advisor empowered to override founders can save both the company and the founders’ long-term reputations.

🔗 The Runway Insights

From Idea to $650M Exit: Lessons in building AI startups (Link)

Some notes from the CEO of Spotify (Link)

How to get on a VC’s radar in 30 days (using only LinkedIn + X) (Link)

Notes from an interview with Jony Ive (Link)

The new TikTok growth marketing guide every Gen Z founder is tapped in with (Link)

💰 Southeast Asia Funding Radar

Roojai, a Thai-based digital insurer, secures $60M from Apis Partners and Asia Partners (Link)

Eluvo secures funding to create a modern, personalised, and premium healthcare model in the Philippines (Link)

Higala raises $4M (Seed) to digitalise rural banks (Link)

3ev raises $14.4M (Series A) to step up EV manufacturing capabilities (Link)

🤝🏻 Before you go: Here are 2 ways I can help you

Founder Office Hours: Book a 1-1 call with me, share your problems and questions, and I'll help you cut through the noise, avoid costly mistakes, and get clear next steps that actually work. I help early-stage founders with:

Validating ideas & building MVPs

Tech & product development

GTM strategy & fundraising

Finding PMF & growth hacks

Growing & monetising newsletters

Attract customers & investors by building a solid founder brand on LinkedIn

Promote your business to 18,000+ founders: Acquire high-value leads and customers for your business by getting your brand in front of highly engaged startup founders and operators in Asia.

💃 Rate Today’s Edition

What'd you think of today's edition?Your feedback helps me create better content for you! |

That’s all for today

Thanks for reading. I hope you enjoyed today's issue. More than that, I hope you’ve learned some actionable tips to build and grow your business.

You can always write to me by simply replying to this newsletter and we can chat.

See you again next week.

- Admond

Disclaimer: The Runway Ventures content is for informational purposes only. Unless otherwise stated, any opinions expressed above belong solely to the author.

Reply